Are you thinking of spreading the cost of your purchase?

Finance is a great way to spread the cost of your purchase, if used responsibly. We have teamed up with Omni, one of the UK’s leading finance specialists, so that you can apply for and complete a loan application quickly and easily – the online application process only takes a couple of minutes to complete, and you will receive confirmation of whether your application has been successful, or referred for further consideration, instantly.

More about our finance options

Our monthly payment plans are designed to help make your purchase more affordable.

We offer a range of interest-free and interest-bearing finance options to help you spread the cost of your purchase:

- Products that are £300 or greater & no more than £15,000 are eligible for our 12 month 0% APR finance option.

(0% finance with a term of 12 months or less is not regulated by the Financial Conduct Authority). - Products that are £500 or greater & no more than £15,000 are additionally available for a 24-month 14.9% APR or 36-month 24.9% APR option.

The minimum deposit required is 10%.

However you can choose a deposit of up to 50% of the value of the goods.

It’s important to remember that you should only enter into a finance agreement if you are sure you can afford the repayments for the full term of the loan. Whichever finance option you choose to apply for, you need to be sure that you can afford to pay the deposit, and keep up with your monthly repayments. You should think about any changes to your situation that might

occur during the term of the loan, which could affect your income or expenditure, for example – retirement, moving home, changing jobs, or any health issues.

Check your eligibility

You can be considered for finance if you:

• Are at least 18 years old

• Are a permanent UK resident and have lived in the UK for at least 3 years

• Have a gross annual income of at least £5,000

• Have a UK bank account capable of accepting Direct Debits

• Have a good credit history with no late payments, Debt Relief Orders, County Court Judgments or bankruptcies

• Meet any other Omni criteria

Please remember that your application for finance isn’t guaranteed to be accepted, and that all applications are subject to status.

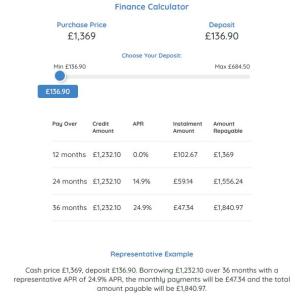

You can find a finance calculator on every product page where the item is eligible for finance:-

Representative examples would be:

| 0% finance over 12 months | 14.9% finance over 24 months | 24.9% finance over 36 months |

| ● Total order value = £600 | ● Total order value = £800 | ● Total order value = £1000 |

| ● 10% deposit = £60 | ● 10% deposit = £80 | ● 10% deposit = £100 |

| ● Total amount of credit = £540 | ● Total amount of credit = £720 | ● Total amount of credit = £900 |

| ● Duration = 12 months | ● Duration = 24 months | ● Duration = 36 months |

| ● Representative APR = 0% | ● Representative APR = 14.9% | ● Representative APR = 24.9% |

| ● Interest charged = £0 | ● Interest charged = £107.28 | ● Interest charged = £224.10 |

| ● 12 monthly payments of = £45 | ● 24 monthly payments of = £34.47 | ● 36 monthly payments of = £31.23 |

| ● Total amount payable = £600 | ● Total amount payable = £907.28 | ● Total amount payable = £1224.10 |

Our finance provider – Omni Capital Retail Finance

The process for making your purchase using finance couldn’t be easier. Simply:

• Place the item (or items) in your basket

• Choose your payment plan

• Complete the application

• Pay your deposit

• Wait for your order to arrive

FAQs

Applying for a loan: Am I eligible to apply for finance?

You are may be eligible to apply for finance if you:

• Are at least 18 years old.

• Have a gross annual income each year of more than £5,000.

• Are a permanent UK resident and have lived in the UK for at least 3 years.

• Have a UK bank account capable of accepting Direct Debits.

• Are not currently bankrupt, subject to an Individual Voluntary Agreement (IVA), or have any country Court Judgements (CCJs).

• Provide an email address so your documentation can be emailed to you.

Will a credit search be registered against me if I apply?

Omni will perform a ‘soft’ credit search on your credit file as part of their assessment, to determine whether the loan is affordable for you and if you are likely to make your repayments on time. It’s important to know that an application for credit will only result in a ‘soft’ search on your credit file until the point your application for finance is complete, at which point a ‘hard’ credit check will be recorded on your credit file. Only you can see that a ‘soft’ search has been made on your credit file, but a ‘hard’ credit check will be visible to others viewing your credit file, for example, if you apply for credit in the future, the lender

will see that an application credit search was made on your credit file.

What happens after I have submitted my application?

Your application will be assessed based on eligibility, credit history and affordability and Omni will let you know the outcome in just a few seconds.

Your application may be referred to a lender for manual assessment and you may receive a request for additional information to support your application.

What happens if my application is accepted?

Once your application is accepted you will be prompted to review and sign your credit documentation. This documentation will detail all the important information about your loan and should be read carefully.

What happens if my application is referred to an Underwriter?

You will receive a response from the Underwriter within 20 minutes of the application being referred during normal working hours. This can either be an accept, decline or a request for more information.

If more information is requested, you will receive an email detailing the information required. If you have any questions, you can contact the Underwriting Team at underwriting@ocrf.co.uk.

What happens if my application is declined?

If your application was declined, Omni may be unable to give you specific reasons why. Omni use information from your credit report, alongside your income and expenditure data to make a lending decision. You will receive an email which will provide further details of the Credit Reference Agencies and contact information for any queries you may have.

Can I get my order delivered to a separate delivery address?

In order to safeguard against fraudulent applications, we are only able to deliver goods to your billing address that is submitted to your finance application.

Collecting my order: What do I need to bring and provide?

When you pick up your goods, please bring a valid photo ID (passport or driver’s license). We’ll take a photocopy of this and we will require your signature on a collection form which we will provide to be signed by the applicant only.

Can someone collect on my behalf?

Unfortunately, only the individual named on the finance application can collect the order.

Managing my loan: When do my monthly repayments start?

After your goods or services have been provided your loan will be activated. Your first Direct Debit payment will be taken approximately 30 days after you receive your welcome email from Omni. This will show on your statement as a payment to Omni.

You can request to change your monthly payment date after the first payment has been made by contacting Omni and speaking to their customer services team on 0333 240 8317. You will also be registered for their Customer Self Service portal, where you will be able to change the payment date yourself.

How can I contact the lender to discuss my loan?

There are three ways to contact Omni:

• Through the Customer Self Service Portal.

• By email at customerenquiries@ocrf.co.uk

• By telephone on 0333 240 8317.

Are there any fees for repaying my loan early?

There may be a fee for early repayment depending on the type of loan. Your Credit Agreement will detail the applicable fees for your product.

Can I cancel my finance agreement?

You have 14 days to cancel your credit agreement, please note that to cancel your goods and services you will need to speak to us directly. Cancelling your finance agreement with Omni without cancelling the goods and services will mean payment for the goods and services will still be required.

If I need to make a complaint, who do I contact?

If you are unhappy with the level of service Omni have provided or anything Omni have done, you can let them know in the following ways:

• By telephone on 0333 240 8317.

• Email: complaints@ocrf.co.uk.

• By Post: Complaints, Omni Capital Retail

Finance Ltd, Customer Services, PO Box 6990,

Basingstoke, Hampshire, RG24 4HX.

Financial Difficulties: Who do I speak to if I want to discuss my loan, or I’m having trouble with my repayments?

Information about how Omni can support you if you miss a repayment can be found on their website:

https://omnicapitalretailfinance.co.uk/money-worries/

Use of personal data

To process your application, you will be asked to provide information about your personal, employment and financial situation. Omni Capital Retail Finance Limited will use your data to determine your finance offer. They will also perform a search with one or more Credit Reference Agencies to conduct checks for creditworthiness and any affordability assessments to help them make their decision.

You can find out more about how Omni Capital Retail Finance Limited uses and protect your personal data at:- https://www.omnicapitalretailfinance.co.uk/privacy-policy/

Omni Capital Retail Finance Limited will provide you with a copy of their Privacy Policy with your loan documents.

Financial Disclosure

Fabtronic/techformusic is registered in England and Wales with company number 04189244.

Registered address: Unit 3, Summerhouse Place, Summerhouse Road, Moulton Park, Northampton, NN3 6GL

Terms and Conditions can be found at www.techformusic.co.uk/terms-of-service/. Fabtronic/techformusic acts as a credit broker and offers credit products from Omni Capital Retail Finance.

Your application will be subject to a credit check using a recognised credit reference agency as part of our assessment process. Credit is subject to status, and is limited to UK residents aged 18 years and over. You can find Omni Capital Retail Finance’s Terms and Conditions at www.omnicapitalretailfinance.co.uk.

Finance is provided by Omni Capital Retail Finance Ltd which is a credit provider/ lender. Fabtronic/techformusic does not receive payment for introducing customers to Omni Capital Retail Finance. Omni Capital Retail Finance Ltd finance options are subject to individual status, and terms and conditions apply.

Omni Capital Retail Finance Ltd is registered in England and Wales with company number 7232938. Registered address: 10 Norwich Street, London, EC4A 1BD. Authorised and regulated by the Financial Conduct Authority, Firm Reference Number: 720279.

PayPal Pay in 3

If you choose to pay via PayPal Pay in 3 HP will debit your account as soon as your order is processed. PayPal Pay in 3 is an interest-free loan that lets you split your basket into 3 payments, with the first due at time of purchase and subsequent payments due every month on the same date. Split your purchases of between £30 and £2,000 into 3 interest-free payments without late fees.

Key information:

- PayPal Pay in 3 allows you to pay for your purchase in three interest-free instalments.

- Your first instalment is due at the time you make your purchase. Your second and third instalment will be due on the following two months.

- Repayments are made automatically from your PayPal account using the funding source you select.

- If you miss a repayment:

- You will be charged a late fee of £12.

- Your credit record may be affected in a way that makes it more difficult or expensive to obtain further credit.

- You may repay the amount you owe in full at any time, without any fees or charges.

- We may carry out a credit check when you apply – if we do, this will leave a mark on your file that can only be viewed by you and not by others.

- We will provide information on how you manage your repayments to credit reference agencies.

- Before you proceed, please carefully consider these terms and conditions and whether you will be able to make the repayments when they are due.

Click here for more information on PayPal’s Pay in 3.

Clearpay Pay in 4

Clearpay lends you a fixed amount of credit so you can pay for your purchase over 4 instalments, due every 2 weeks. Ensure you can make repayments on time. You must be 18+ and a permanent UK resident (excl. Channel Islands). Clearpay charges a £6 late fee for each late instalment and a further £6 if it’s still unpaid 7 days later. Late fees are capped at £6 for orders under £24 and the lower of £24 or 25% of the order value for orders over £24. Missed payments may affect your ability to use Clearpay in the future and your details may be passed onto a debt collection agency working on Clearpay’s behalf. Clearpay is credit that is not regulated by the Financial Conduct Authority. T&Cs and other eligibility criteria apply at clearpay.co.uk/terms